Skim Simpanan Pendidikan Nasional Tax Relief

SSPN-i Plus merupakan satu skim atau pelan simpanan yang direka oleh Perbadanan Tabung Pendidikan Tinggi Nasional PTPTN untuk penabungan bagi tujuan pendidikan tinggi. Enter PTPTNs Skim Simpanan Pendidikan Nasional SSPN-i.

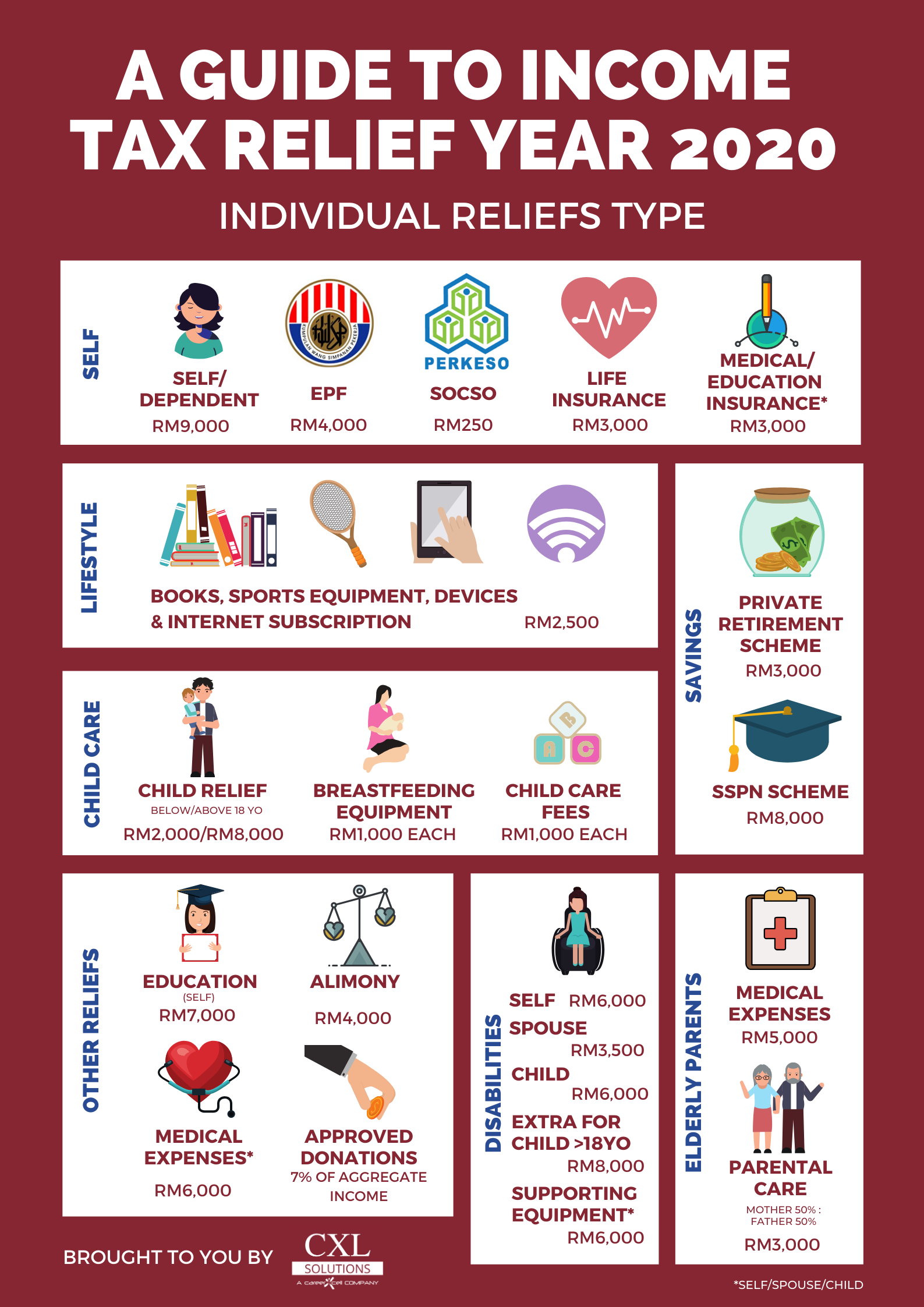

Malaysia Income Tax A Quick Guide To The Tax Reliefs You Can Claim For 2020 Buro 24 7 Malaysia

Child education insurance policy Maximum RM3000.

Skim simpanan pendidikan nasional tax relief. Medical expenses for parents. SSPN-i merupakan satu skim simpanan pendidikan terbaik yang ditawarkan oleh PTPTN bagi menggalakkan penabungan untuk pendidikan tinggi anak-anak pada masa hadapan. To further encourage parents to save for the costs of their childrens higher education fees the tax relief of up to RM8000 will be extended until year assessment year 2022.

SSPN-i dan SSPN-i Plus merupakan produk simpanan PTPTN. The Takaful coverage is also increased to RM1 million for. Up to a value of RM6 000 per year.

Back to our question. Self and Dependent Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Feb 23 2021 What is Skim Simpanan Pendidikan Nasional SSPN.

SSPN-i Plus ditambahbaik daripada SSPN-i sedia ada dengan perlindungan takaful yang murah dan komprehensif. From the income tax saving perspective if you are in the highest income tax bracket of 26 and you deposit RM6000 into the SSPN-i account for your children you will enjoy a tax relief of up to RM6000 x 26 RM1560. You might probably be interested to also read about.

There are four areas that you can take advantage of tax relief for education purposes. 5000 Limited 3. SSPN National Education Savings Scheme is a savings scheme for higher education launched in 2004SSPN was introduced by the.

I think it represents a good alternative investment vehicle in Malaysia. National Education Savings Scheme SSPN-i By Leckas on Wednesday April 14 2021. Simpan di SSPN untuk menikmati.

What are the returns pros and consUpdated. Anda boleh membuka kedua-dua jenis akaun SSPN untuk anak yang sama. For those who wants to purchase new smart phones or tablets or laptops please do it by 31122020 to utilise the new RM2500 tax relief.

Skim ini menawarkan dividen yang kompetitif perlindungan percuma pelepasan taksiran cukai sehingga RM8000 geran sepadan sehingga rm10000 patuh syariah dan dijamin oleh kerajaan Malaysia. You can check for the updated account statement and print it out for income tax relief of up to RM6000 per year. SSPN-i Plus menggunapakai konsep simpanan secara komitmen bulanan dan jumlah simpanan.

SSPN-i Plus mengguna pakai konsep simpanan bulanan dan jumlah simpanan adalah bergantung. Skim Simpanan Pendidikan Nasional SSPN. Amount RM 1.

Skim Simpanan Pendidikan Nasional SSPN adalah skim atau instrumen simpanan yang direka oleh Perbadanan Tabung Pendidikan Tinggi Nasional PTPTN bagi tujuan pendidikan tinggi. Book purchase Maximum RM1000. This relief is applicable for Year Assessment 2013 and 2015 only.

Does it worth to put saving in Skim Simpanan Pendidikan Nasional SSPN-i. Extension of period for tax relief in respect of net annual contributions to the national education savings scheme Skim Simpanan Pendidikan Nasional. If you have been looking for ways to pay less income tax this would be it.

SSPN adalah produk patuh syariah yang diperkenalkan oleh PTPTN serta simpanan dijamin oleh kerajaan dan mempunyai pelbagai keistimewaan. Should I invest in SSPN-i previously known as SSPN1M for my childs higher education. Does it worth to put saving in Skim Simpanan Pendidikan Nasional SSPN-i.

Skim Simpanan Pendidikan Nasional Maximum RM3000. Remember to make contribution for your Private Retirement Scheme PRS and Skim Simpanan Pendidikan Nasional SSPN before 31122020 in order to claim your tax relief in Year 2021. How to top up SSPN-i saving using Maybank2u.

Currently there is nothing much in the website. Skim Simpanan Pendidikan Nasional SSPN-i or National Education Savings Scheme is a savings scheme from Perbadanan Tabung Pendidikan Tinggi Nasional PTPTN or National Higher Education Fund Corporation. For instance these savings are tax deductible.

For instance the income tax relief is increased to RM12000. Post graduate education Maximum RM5000. SSPN-i Plus merupakan satu skim atau pelan simpanan yang direka oleh Perbadanan Tabung Pendidikan Tinggi Nasional PTPTN untuk penabungan bagi tujuan pendidikan tinggiSSPN-i Plus ditambahbaik daripada SSPN-i sedia ada dengan perlindungan takaful yang murah dan komprehensif.

Skim Simpanan Pendidikan Nasional SSPN adalah merupakan satu skim atau instrumen simpanan yang direka khas oleh Perbadanan Tabung Pendidikan Tinggi Nasional PTPTN bagi tujuan pendidikan tinggi.

Here S How To Maximise Your Education Income Tax Relief

The 8th Voyager Does It Worth To Put Saving In Skim Simpanan Pendidikan Nasional Sspn I

Top 4 Methods To Enjoy Tax Relief For Education Purpose Kclau Com

Malaysia Income Tax A Quick Guide To The Tax Reliefs You Can Claim For 2020 Buro 24 7 Malaysia

Breaking It Down Income Tax Relief For The Year 2020 Ya 2019 Cxl

Budget 2021 Tax Relief For Sspn Prs Savings Extended

Skim Simpanan Pendidikan Nasional Malaysian Taxation 101

The 8th Voyager Sspn I Tax Relief Of Rm6000 Max Has Been Extended Until Year 2020

Posting Komentar untuk "Skim Simpanan Pendidikan Nasional Tax Relief"